Interrupting My Series on the Economics of Abortion-

You’re About to Get Shafted Again by Chained-CPI Via Stealth Tax Increases

While working on the next installment of my series on the economic impact of abortion, I was prompted to address the truth about chained-CPI by a Republican in my Twitter timeline. He mentioned he “likes” the concept, but I sense that like many who have not seriously looked at the facts and data surrounding chained-CPI, his opinion is based on sound bites rather than real analysis. To provide a little background, this individual is young, and I assume is either a GenXr or a Millennial. Understandably, both of these generations have everything to complain about when it comes to the situation that exists in the Social Security scheme. We all do. It’s been a shell game since first cooked up by Keynesian economist, Alvin Hansen back in the 1930s. Enter the latest proposal by the Republicans and Democrats to “fix the system”—chained-CPI.

There are many Democrats screaming against chained-CPI, (which would naturally make a conservative wonder if they’re against the proposal it must be good) as faithful conservatives we are compelled to ask our own questions rather than relying on partisan hype from either side of the aisle. Let’s tear it down and look behind the curtain independently.

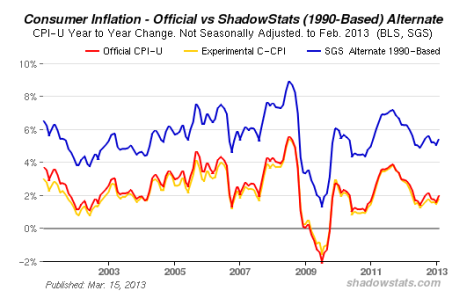

First of all, to believe bare-bones CPI is truthfully reported requires one to suspend all disbelief. It is not a true reflection of real inflation in anything but an alternate universe. I believe most of my readers are well aware of this already, so I won’t bother to provide the historically shady actions of previous administrations (both parties) to “adjust” CPI to paint a rosy picture of the economy on their individual watches. For those wanting to review the history, please visit economist, John Williams’ data on the historical adjustments to CPI. Below is the current chart from Shadow Stats for an accurate view of real CPI-U. Chained-CPI comes out of the gate at the onset with a fictional base on which the government bureaucrats will make adjustments:

Chained-CPI is even worse than the fable of CPI-U

Re-weighting Bias

To begin, it’s important to remember that calculations of inflation have consistently lowered inflation figures rather reflect any increases. This does not benefit you, it benefits the government and the Federal Reserve and the perpetual lies they spew.

Chained-CPI will use geometric mean rather than arithmetic mean. In financial mathematics, computation using geometric mean is less than arithmetic mean if all numbers are equal. Therefore, chained-CPI will understate real inflation data based on this theorem alone.

CPI is re-weighted by looking back in time, not current and not forward. This leaves open the opportunity to re-weight CPI by favoring those items that will give the appearance of lower inflation— naturally to favor the actors in the Beltway.

Tastes Great, Less Calories?

Politicians pushing chained-CPI would like you to believe it’s a palatable solution for cutting costs. The pro-chained-CPI argument relies on the premise it will save money based on a more accurately reflected rate of inflation, and therefore save Social Security with little effect on anyone but those who are dependent on benefits. They rarely mention this also includes a cut in veteran’s benefits– those amongst us who deserve our loyal support for having laid there lives on the line for us. We have come to expect Democrats to push cutting benefits and programs for veterans, but the curtain is pulled back where Republicans stand as well on this topic if they support switching to chained-CPI as far as I’m concerned.

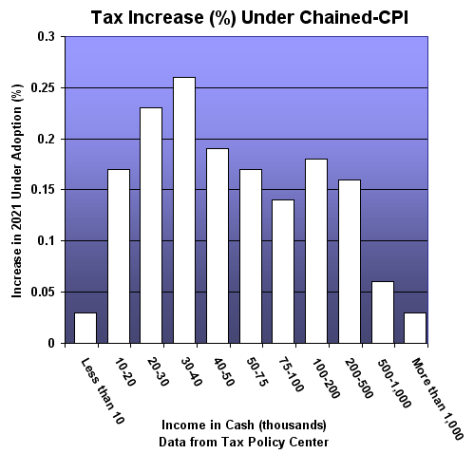

Republicans would also like us all to believe that they are against tax increases. This is a stalwart principle of conservatism. Yet, if a tax is stealthy they often rely on the probability the conservative base won’t be savvy enough to catch them raising taxes. Let’s look at the tax increases under chained-CPI. Keep in mind current tax code adjusts tax brackets via CPI-U, and this will be switched to chained-CPI should this proposal pass. What does this mean for you? Tax brackets will be adjusted less frequently, and if your income rises you’ll be pushed into a higher tax bracket.

Most leftists would point out in the chart above that millionaires are getting away with a small increase, which is true. They’re already being punished by the highest possible tax bracket under current progressive tax policy! Bracket creep cannot change for the “more than a million” in income unless Congress cooks up a higher bracket. But what of the middle-class? Both sides of the political spectrum beat their chests that they want a stronger middle-class, yet look at the chart and see who will be hit the hardest by chained-CPI—the middle class! As noted by the Cato Institute, “It would be an anti-growth tax increase because it would push families into higher tax brackets more quickly over time, subjecting them to higher marginal tax rates.” Further, the Joint Committee on Taxation in Congress reported that if individual income taxes were indexed to the Chained CPI starting in January 2013, by 2021, sixty-nine percent of the gains in revenue (the now common nomenclature for taxes) would come from taxpayers with incomes below $100K. They will raise taxes via tax brackets that will provide an automatic increase forever!

The Hoax That is Chained-CPI

The basic premise of chained-CPI relies on the notion that inflation comes down as people switch to lower priced items while normally purchased items increase in price, therefore it’s a more accurate and timely measure of inflation. The entire concept becomes twisted right then and there. Of course people will switch to lower priced items as INFLATION increases! They have no choice, unlike the Federal Government, to cut corners and stay within a budget! If ground beef becomes too expensive, people switch to chicken. If chicken becomes too expensive I guess they’ll switch to cat food. This is how chained-CPI is recalculated! Forget current monetary policy is killing purchasing power. Forget real wages have not increased since the 1970s. Let’s breakdown this policy:

- Inflation increases under current monetary policy and consumers tighten their belts and buy cheaper goods to take care of their needs

- Chained-CPI is calculated based on YOU tightening your belt to substitute for higher priced goods and stay within a budget

- Because you tighten your belt to stay within your household budget the government will now increase taxes across the board, AND cut benefits to seniors, the disabled and veterans.

- The vicious cycle continues to reduce your living standard because higher taxes and cuts to benefits will once again force ALL consumers to buy even lower priced items or simply go without altogether. The Chained-CPI will once again be lowered due to your prudent fiscal behavior!

- Seniors and savers who are already being punished by zero interest rate policy take yet another hit to income. This, by far, is the most heinous part of chained-CPI and adds insult to the ongoing injury by the Federal Reserve.

This is not a partisan issue- this is insanity wrought on all of us! This will not fix Social Security, as I will show with further installments on the economics of abortion. The pyramid that supports Social Security has been horribly reduced by killing 56 million babies over the past forty years. Replacing that loss in our population will not be solved by more fiscal “tricks.” Perhaps Crazy Joe Biden wasn’t too far off when he made his infamous “chains” claim during the 2012 election. Both parties are planning to keep us in economic chains with Chained-CPI whether it’s a cut in benefits or a hike in your taxes!

Repeat after me: There is nothing conservative or free-market about raising taxes.

You must be logged in to post a comment.